Therefore, knowing how to control bank fees is extremely important. The following article will help you learn how to control bank fees effectively, save costs while still ensuring service quality.

REASONS WHY BANK FEES MAY INCREASE

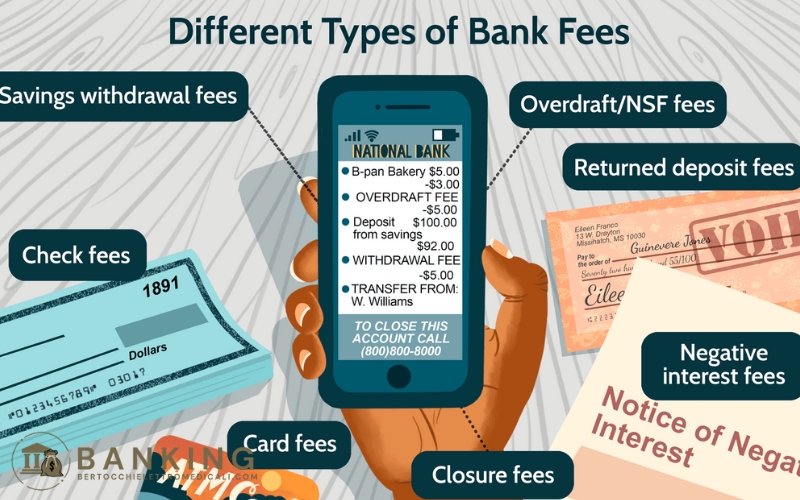

Before learning about methods to control bank fees, we need to understand why these fees can increase. Banks offer a wide range of convenient services, but these services often come with fees to keep the system running. These fees may include:

Account maintenance fee: This is a fee that banks charge customers to maintain a personal or business account. Some banks may waive the fee for accounts with large balances or if you make enough transactions during the month.

Transfer fees: Transfers within and outside the banking system may incur fees, especially if you transfer money on weekends or during inconvenient business hours.

ATM withdrawal fees: Withdrawing money from ATMs outside your bank’s system or withdrawing money from ATMs of other banks may also incur fees.

Other service fees: These include credit card fees, card debt repayment fees, international transaction fees, or fees associated with using special bank services.

Although these fees may not be too large for each transaction, if not paid attention to, they can add up and form a significant expense. Therefore, controlling and optimizing these fees is extremely necessary.

EFFECTIVE WAYS TO CONTROL BANK FEES

To minimize unnecessary bank fees, users can apply some of the following strategies:

1. CHOOSE A BANK WITH LOW OR FREE SERVICE FEES

One of the easiest ways to control bank fees is to choose a bank with reasonable service fees. Banks are currently competing fiercely to attract customers, so they often offer free or reduced-fee offers for certain services.

Before opening a bank account, you should carefully study the fees applied to the services you regularly use. Some banks offer free or reduced-fee accounts if you maintain a minimum balance or make a certain number of monthly transactions. Comparing banks and choosing the one with the right service fee will save you money in the long run.

2. USE THE RIGHT ACCOUNT AND CARD

One way to effectively control bank fees is to use the right account or card for your financial needs. Credit or debit cards can have different fees depending on the type of card you choose. For example, credit cards may come with fees such as cash advance fees, late payment fees, or foreign currency conversion fees.

Depending on your needs, you can choose cards with no annual fee, or cards that offer free ATM withdrawals within the system. Debit or prepaid cards are also a good option if you don’t want to incur interest charges from using a credit card.

3. TRANSFER MONEY THROUGH FREE CHANNELS

Transfer fees are one of the common fees that users often have to pay when making banking transactions. However, if you know how to choose the right channel, you can save a significant amount of money. Many banks now offer free transfer services when making transactions via mobile apps or bank websites.

You can also take advantage of internal bank transfer services, as these transactions are often free or have very low fees. If you need to transfer money internationally, learn about international money transfer services with low or no fees, such as transferring through online payment applications or using banks with a large transaction network.

4. USE YOUR BANK’S ATM

Withdrawing money from ATMs of other banks outside the system will result in you paying a withdrawal fee. To avoid these fees, you should try to use ATMs of the bank where you have an account. If your bank has a large network of ATMs, you can easily withdraw money without worrying about transaction fees.

If you need to withdraw money from another bank’s ATM, check the withdrawal fee in advance to avoid surprises. Many banks have now reduced withdrawal fees at ATMs outside the system or offer some withdrawals free of charge during the month.

5. CHECK AND MANAGE TRANSACTION HISTORY

To effectively control bank fees, you need to regularly monitor your transaction history. Checking your account fees will help you identify unnecessary charges or detect unusual transactions.

Banks provide SMS or email notifications for every transaction in your account, making it easy to track and control. You can also use personal finance management tools to track your spending and identify unwanted fees.

6. READ THE CONTRACTS AND TERMS CAREFULLY

One way to avoid unnecessary fees is to carefully read the terms of the contract before signing up for banking services. Many banks have terms of service fees, hidden fees when opening an account or using a credit card that you may not notice if you do not read carefully. Make sure you understand the applicable fees before deciding to use the bank’s services.

CONCLUSION

Controlling bank fees is an important part of effective personal finance management. By choosing a bank with reasonable service fees, using free transaction channels, and tracking your transaction history, you can save a significant amount of money throughout the process of using banking services. Controlling fees not only helps you reduce your financial burden but also helps you optimize the services that the bank provides, thereby improving the quality of personal finance management.